Tax brackets 2022 calculator

7 rows Personal Relief applies to individuals with taxable income are entitled to a personal relief of KSh2400 per month and up to KSh28800 per year as from January 2022. Income falling within a specific bracket is taxed at the rate for that bracket.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Calculate your combined federal and provincial tax bill in each province and territory.

. Simple tax calculator Australian Taxation Office Simple tax calculator This calculator helps you to calculate the tax you owe on your taxable income for the full income year. Personal tax calculator. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates.

2022 Simple Federal Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes. You can also create your new 2022 W-4 at the end of the tool on the tax. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. It can be used for. Depending on the changes made to tax rates a change in the IRS tax liability may follow.

The current tax rates 2017 consist of 10 15. US Income Tax Calculator 2022 The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. 2022 Tax Calculator 01 March 2021 - 28 February 2022 Parameters Period Daily Weekly Monthly Yearly Periods worked Age.

The surcharge is calculated at the rate of 1 to 15 of your income for Medicare Levy Surcharge purposesThis is in addition to the Medicare Levy of 2 which is paid by most Australian. And is based on. 0 would also be your average tax rate.

The personal income tax rates rates below for resident and non-resident income tax calculations are for the 2022 tax year. For more information about your how your 2019-2020 tax rates differ from the new 2020-2021 IRS tax. Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Calculate the tax savings. Your Federal taxes are estimated at 0. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Property taxes are the major source of revenue for Moca and the rest of local public districts. Theyre a funding anchor for governmental services used to maintain cities schools and. This is 0 of your total income of 0.

Online income tax calculator for the 2022 tax year. Based on your projected tax withholding for the year we can. 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory.

As of 2016 there are a total of seven tax brackets. Estimate your tax refund with HR Blocks free income tax calculator. Please note that Jamaica uses a split annual tax calculations which.

Tax rates range from 0 to 45. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022. The table below shows the tax brackets for the federal income tax and it reflects the rates for the.

Your tax bracket is. Finally Illinois enacted an optional pass-through entity tax for 2022 through 2025. The calculator reflects known rates as of June 1 2022.

With our Tax Bracket Calculator above youre closer to getting every dollar you deserve. The Tax Caculator Philipines 2022 is. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available.

The state income tax rates are 495 and the sales tax rate is 1 for qualifying food drugs and medical. See where that hard-earned money goes - with Federal Income. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income.

It is mainly intended for residents of the US.

Income Tax Formula Excel University

How To Calculate Federal Income Tax

Income Tax Formula Excel University

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

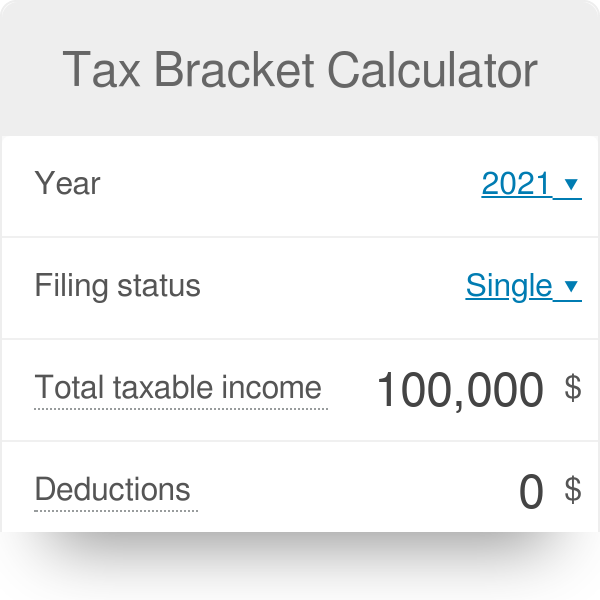

Tax Bracket Calculator

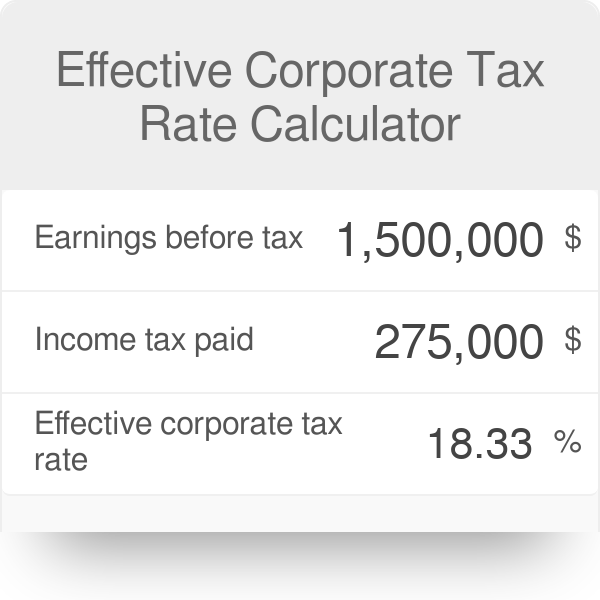

Effective Tax Rate Formula Calculator Excel Template

Excel Formula Income Tax Bracket Calculation Exceljet

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Paycheck Calculator Take Home Pay Calculator

Effective Corporate Tax Rate Calculator

Tax Calculator Estimate Your Income Tax For 2022 Free

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Sales Tax Calculator

Komentar

Posting Komentar